LOL.

You had been warned with plenty of advance time duration as a cushion. In fact, the first posting on this blog began as early as November 20, 2011.

Anyway, right now as of July 24, 2020 is as good a time as any to post a reality marker.

SIGNING OFF!!!

P.S.

And good luck! In all likelihood, you will (we ALL will) very badly need it. What comes next will be THE MOST "interesting" (or chaotic & frightening) turbulence imaginable, at least for the next 4 to 6 months.

Collapse of Fiat Currency Model under Central Banking System

Globally interconnected central banks, esp. Fed and crushing sovereign national debts: Serious concerns for stability of fiat currencies, esp. global reserve US$

Friday, July 24, 2020

Monday, March 18, 2019

GROUNDHOGGING on the PERPETUAL Groundhog Day, Yo!

As the world predictably went to HELL, as had been accurately predicted by the very first post of this blog in November 2011 (a prediction of ours for which we take NO pride in having come true):

In celebration of the PERPETUAL Groundhog Day, the contents of this blog had already long ago migrated here:

No Propaganda Zone

As in, actually starting as early as November 2012 from right over here:

Groundhog Day Inauguration!

GROUNDHOG AWAY!!!

See you on the other side of the river.

For those of you who make it, that is.

In celebration of the PERPETUAL Groundhog Day, the contents of this blog had already long ago migrated here:

No Propaganda Zone

As in, actually starting as early as November 2012 from right over here:

Groundhog Day Inauguration!

GROUNDHOG AWAY!!!

See you on the other side of the river.

For those of you who make it, that is.

Wednesday, August 13, 2014

Groundhog Day News Bulletin

This portion of the Groundhog Day news bulletin is jointly sponsored by JPMorgan and Goldman Sachs:

The Iraq War has now begun. The Mission has been Accomplished.

Really.

Till tomorrow's Groundhog Day news bulletin, which will include special Cold War coverage followed by coverage of the World War.

The Iraq War has now begun. The Mission has been Accomplished.

Really.

Till tomorrow's Groundhog Day news bulletin, which will include special Cold War coverage followed by coverage of the World War.

Thursday, July 17, 2014

Woodrow Wilson's Eternally Haunted Ghost

Remember the Lusitania.

(Up, and down. And in the end, it's only round and round. And round. - Roger Waters)

(Up, and down. And in the end, it's only round and round. And round. - Roger Waters)

Friday, April 11, 2014

JPMorgan quoting Martin Luther King/injustice, Goldman Sachs CEO doing "God's" work

Twilight zone boundary has officially been crossed.

Even Hollywood couldn't possibly come up with a script more absurd than JPMorgan's Jamie Dimon repeating Martin Luther King's injustice quotes, claiming to be a "beacon of justice in an increasingly corrupt financial world". This after Goldman Sachs' Lloyd Blankfein claimed he was doing "God's" work!

So let's fact-check what these "God's work" and "beacon of justice" involve. That would be plunging the populations of the world hook, line, and sinker into throes of World War III through cacophonous propaganda.

Sheer magnitude of absurdity of such farce is so enormous, it makes you wonder if these dare-you stunts are their intentional tactics.

Update in other news:

Blythe Masters needs 2 bodyguards to accompany her wherever she goes at all times.

Even Hollywood couldn't possibly come up with a script more absurd than JPMorgan's Jamie Dimon repeating Martin Luther King's injustice quotes, claiming to be a "beacon of justice in an increasingly corrupt financial world". This after Goldman Sachs' Lloyd Blankfein claimed he was doing "God's" work!

So let's fact-check what these "God's work" and "beacon of justice" involve. That would be plunging the populations of the world hook, line, and sinker into throes of World War III through cacophonous propaganda.

Sheer magnitude of absurdity of such farce is so enormous, it makes you wonder if these dare-you stunts are their intentional tactics.

Update in other news:

Blythe Masters needs 2 bodyguards to accompany her wherever she goes at all times.

Saturday, March 22, 2014

Bank of England issues BIZARRE psyops Whitepaper & self-incriminating PR Video

Against this backdrop, I'm quite literally shocked to come across some new material released by the Bank of England. I have no idea what to make of this. I'm unable to discern their motivation behind these releases, specifically why they would go to such extents self-incriminating themselves.

I believed that rule numbers 0 and 1 of Central Banking Cartel rulebooks were something like:

- Never, ever, ever, ever, EVER officially disclose the Secrets of the Temple.

- Never, ever, ever, ever, EVER voluntarily tell the truth.

What is mindblowing about the Bank of England releases is, for the first time someone from inside the Temple has gone on record and documented their frauds in painstaking details!

The first release I'm referring to, is following fairly detailed 14 page whitepaper. It quite literally spills the beans that the worthless fiat currencies with which they control lives of mass populations of the planet are not worth toilet papers with low cost ink applied to them. The Temple uses magician Mandrake powers to pull them out of their hats or the butts of bunnies. The interest rate mechanism they use to toy with lives of billions are totally arbitrary. They even go on to lengths discussing the scam of Quantitative Easing. They sugar-coat it and attempt to justify some rationality behind it. But this facade is so weak, it falls away for anyone possessing even the slightest modicum of logic.

Instead of sticking with my ramblings, check out the whitepaper at below link yourself and knock yourself out:

Whitepaper: Money creation in the modern economy

This article explains how the majority of money in the modern economy is created by commercial banks making loans.As if above whitepaper format were not enough, they even go to the extent of creating a self-incriminating youtube video going over this topic over 5 minute duration.

Money creation in practice differs from some popular misconceptions — banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits.

The amount of money created in the economy ultimately depends on the monetary policy of the central bank. In normal times, this is carried out by setting interest rates. The central bank can also affect the amount of money directly through purchasing assets or ‘quantitative easing’.

Video: Money creation in the modern economy - Quarterly Bulletin article

Apart from the fact that they're directly going anywhere near this topic, the bizarrely surreal part I find about this video is the strange backdrop they used to shoot it against. It almost has a subliminal psyops quality to it, given that when communicating officially with Temple outsiders, all central banker personnel are expected to display disdain, indifference or hatred towards real money. What in the world are they trying to achieve with this video? Are all those fake tungsten bars they're surrounded with, using them as a psyops backdrop for hypnotism? There have got to be strong hidden motivations behind these PR stunts. But my cynical self is left scratching head making sense of all this sensory overload. I know, I'm being redundant. But this is highly surreal and bizarre. It might be the only time we'll ever see any official dissemnination of this nature from inside a Temple, the first and the last time!?!

Quite logically, I'm not the only one left with curious and confusing feelings by these releases. Someone from "mainstream" press has been quick to pick them up. Like me, this press article also wonders aloud the motivations behind all this circus. Only possible explanation with rudimentary logic behind the strangeness could be as follows: It is perhaps a desperate pre-emptive attempt of damage control, and so it could be a harbinger of serious turbulence to arrive over short term?

The truth is out: Money is just an IOU, and the banks are rolling in it. The Bank of England's dose of honesty throws the theoretical basis for austerity out the window

Back in the 1930s, Henry Ford is supposed to have remarked that it was a good thing that most Americans didn't know how banking really works, because if they did, "there'd be a revolution before tomorrow morning".

Why did the Bank of England suddenly admit all this? Well, one reason is because it's obviously true. The Bank's job is to actually run the system, and of late, the system has not been running especially well. It's possible that it decided that maintaining the fantasy-land version of economics that has proved so convenient to the rich is simply a luxury it can no longer afford.

Sunday, March 16, 2014

Game Over, Mr. Woodrow Wilson

After August 15, 1971, a day that has lived in infamy - arrives March 16, 2014 to mark the beginning of the end of a sordid era.

Mr. Woodrow Wilson, your gig is up.

Mr. Woodrow Wilson, your gig is up.

Sunday, November 3, 2013

Finland, Sweden Store their Gold with Bank of England. Or NOWHERE at all!

Peculiar story was reported due to intense public pressure in Finland (and likewise Sweden) about audit of their respective central banks' gold holdings.

Finland's Gold

Curiously, both of these nations use Bank of England to hold majority of their gold! And in case of Sweden, add in significant amount held by Bank of Canada, which means both Scandanavian nations have possession of very small proportions of gold they claim to "own on their books".

But the story gets even weirder. Apparently, large chunks of these gold reserves supposedly held by Bank of England are not really "physically" held by Bank of England at all! Rather, they have been recycled back into global markets as "investment activity".

Finland's Gold

Curiously, both of these nations use Bank of England to hold majority of their gold! And in case of Sweden, add in significant amount held by Bank of Canada, which means both Scandanavian nations have possession of very small proportions of gold they claim to "own on their books".

| Location | Sweden | Finland | |||

| Bank of England | 61.4 | 25.0 | |||

| Swedish Riksbank | 15.1 | 9.8 | |||

| New York Fed | 13.2 | 8.8 | |||

| Swiss National Bank | 2.8 | 3.4 | |||

| Bank of Finland | - | 2.0 | |||

| Bank of Canada | 33.2 | - | |||

| Total | 125.7 | 49.0 |

But the story gets even weirder. Apparently, large chunks of these gold reserves supposedly held by Bank of England are not really "physically" held by Bank of England at all! Rather, they have been recycled back into global markets as "investment activity".

Maximum half of Finland's gold has been within investment activity over the years. Gold has been invested among other things in deposits similar to money market deposits and using gold interest rate swaps. Gold investment activity is common for central banks. The risks associated with gold investments are controlled using limits, investment diversification and limitations concerning duration.The most salient point about this is, how it relates to supposedly "rigged" low price of gold in international market as a profound anomaly. It otherwise cannot be explained in light of enormous amounts of gold being stocked by Reserve Bank of India, People's Bank of China and other Asian nations in recent years.

The evidence is mounting that Western central banks through the Bank of England have been feeding monetary gold into the market through leasing operations. Indeed, the Finnish blog says as much: "Gold investment activities are common for central banks".

This explains in part how the voracious appetite for gold by China, India and South-East Asia is being satisfied, without the gold price rising to reflect this demand.

Friday, November 1, 2013

Federal Reserve publishes report exposing its own SCAM!

Quite a sight to see that Federal Reserve itself has published a report exposing its own scam!

Federal Reserve’s Balance Sheet and Earnings: Primer & Projections

From page 5 of this report:

But it gets even worse. Looking at "Remittances to Treasury" graph on page 30 of this report, and following reference to it on page 21:

Obviously, this begs the question about why do American people need this meddling private central bank in the first place, obfuscating and fudging interest rates and creating nefarious buffer between themselves and US Treasury? The answer is simple. If it weren't for these cronies and their debt ridden tricks of creating more and more worthless money out of thin air, it would be impossible to finance perpetual war machine, and it would be impossible to keep kicking can of debt down the road onto future bankrupted generations.

Federal Reserve’s Balance Sheet and Earnings: Primer & Projections

From page 5 of this report:

In the baseline projection, we assume no MBS sales, consistent with the Chairman’s comments in his June 2013 press conference. The size of the SOMA portfolio will normalize by August 2020. Despite the normalization of the size of the portfolio, the composition of the portfolio will still reflect the nontraditional policy choices; at the end of our projection period in 2025, over $400 billion of MBS will remain on the Federal Reserve’s books. Annual remittances to the Treasury are projected to remain sizable over the near term and cumulate from 2009 - 2025 to about $910 billion. Overall, this scenario suggests that large-scale asset purchases will have a net positive effect on income relative to a scenario with no purchases, but the Federal Reserve will continue to hold MBS for some time.Translated in layman terms: It could be until August 2020 for the worthless dollars being printed at an alarming rate by Fed through QE to be flushed out of the system! And this is termed as a "baseline" scenario with no huge interest rate hikes - which are in fact expected as an open secret to be around the corner to prevent threat of hyperinflation! MBS in that paragraph refers to "mortgage backed securities" which Fed has been buying at an alarming rate through its QE fraud, because it can't find any backers (like China) to buy this debt-ridden junk anymore. Fed has become the "buyer of last resort" for these debt-ridden bonds, because there are no other takers of the "pie in the sky" promises of future American debt being repaid. It can take until staggering 2020 for evaporating such crushing debt, and that's just considered a "baseline" (to be read as: not realistic) scenario!

But it gets even worse. Looking at "Remittances to Treasury" graph on page 30 of this report, and following reference to it on page 21:

The income projection, as shown in Figure 5, does change, however. The higher federal funds rate implies greater interest expense. Once combined with noninterest income and expenses, remittances to the Treasury fall to zero for a few years and a deferred asset is booked for 2017 through 2019.Translated in layman terms: Under these high-interest rate realistic situations, there could be number of years when the Fed doesn't pay a single penny to US Treasury, and it could be until 2019 that the Fed's balance sheet stabilizes to what's deemed "normal"! No, "normal" here by no means refers to evaporation of all debt through QE. It just means, being able to get back to today's debt-ridden condition. What is deemed "normal" for these cronies is considered "abnormal" for population of ordinary serfs, because of them having the exalted status and all.

Obviously, this begs the question about why do American people need this meddling private central bank in the first place, obfuscating and fudging interest rates and creating nefarious buffer between themselves and US Treasury? The answer is simple. If it weren't for these cronies and their debt ridden tricks of creating more and more worthless money out of thin air, it would be impossible to finance perpetual war machine, and it would be impossible to keep kicking can of debt down the road onto future bankrupted generations.

Wednesday, October 30, 2013

Discussion in Oman to NOT Peg Riyal to Devaluing US Dollar

Columnists in Oman kicked off open discussion about vulnerability of dependence on US Dollar in Times of Oman over the weekend.

Should Sultanate of Oman drop riyal peg to US dollar?

Should Sultanate of Oman drop riyal peg to US dollar?

United States floundering finances and internal political bickering is forcing the once mighty nation to lose its grip on the treasury.Arguments made in above quotes about serious dangers of sticking with status quo are so eloquent, that no further commentary really needs to be added to strengthen them. Simply by providing a wrapper functionality in this short blogpost is sufficient to drive home the point.

Many critics say that sticking to the dollar peg is as good as devaluing the rial since the US currency is losing its strength consistently against major currencies of the world. Oman and its neighbours are big buyers of the dollar dominated assets and the need to diversify its portfolio away from the US currency is very pressing.

The US government's shut down this month should be another wake up call for Oman to consider ending its reliance of the dollar. How could Oman continue to keep its faith in the dollar when the US government has no control over its own currency?

Tuesday, October 29, 2013

Saudi Arabia sets out to DEMOLISH Petrodollar status!

From "if only lives of billions of innocents were not so hopelessly dependent on insane criminality of globalist banksters, it would be freakishly hilarious" department:

Without directly quoting from this disgustingly depressive article about violent propaganda, geopolitical aspirations of Saudi royal family in the entire Middle East for resource-grab of all crude oil reserves, meddling around in Bahrain, Kuwait, Egypt and many more nations, Saudi arms race with Iran and many more unstated points too numerous to mention - Basic macroeconomic implications of this mess are as follows:

- Apart from missiles, bombs and drones, the biggest American export is its "under-threat by own debt crisis and increasingly impatient Chinese controlled" fiat US Dollar currency. By definition, it is backed by absolutely nothing, except threats of warfare with missiles, bombs and drones, imbalanced/rigged trade treaties and globalized surveillance spying using newer and newer high-tech business intelligence algorithms.

- [Seriously, ponder more and more on above point. Are these really the signs of philosophical enlightenment and prosperity, values of freedom and liberty, and justification for moral high ground? This propagandized situation is no different from how British parliament used propaganda to justify imposing Opium war on China, or forced indigo farming apartheid in Bihar/Bengal, India.]

- With diminishing manufacturing and service outputs, debt-ridden and increasingly propagandized/brainwashed population addicted to garbage consumer goods they don't need like wasted druggies are addicted to crack cocaine, what kept the fiat US Dollar propped up as "reserve currency" for such a long time? It basically had its "Petrodollar" status, with Saudi royal family being the biggest partners in crime propping it up. This means, it was guaranteed that all global trade of petroleum would have to occur in US Dollar.

- Now consider the weakened state of US Dollar completely unrelated to all of Saudi Arabia-Iran/Syria/Lebanon cold war drums. As blogged before, various Asia Pacific economic powerhouses are putting their houses in order, setting up trade deals independent of US Dollar.

- Saudi Arabia having become addicted to using "Petrodollar guarantee" as a blackmailing tool have been taking for granted use of American military resources to carry out dirty deeds and achieve their geopolitical ambitions. In other words, what would Saudi royals care if some 18 year old boy from Kentucky in US Army died fighting in some dubious war in Iraq, as long as it helped them achieve goal of Middle East geopolitical domination and escalating arms race with Iran? For the Petrodollar guarantor-American arms importer Saudis, those American kids dying or getting critically maimed/wounded have been worthless collateral noise, as long as their goals were being achieved.

- Under such precarious conditions, if Saudis get push-back on use of American kids dying fighting against Iran or Syria - neither of whom have directly threatened or attacked USA - only course of action from them can be to blackmail US into dumping Petrodollar status. Knowing the increased vulnerability to US Dollar from China slowing down purchases of US Treasuries, this would be some serious blackmail indeed.

- The moment Saudi Arabia starts - in spite and revenge - using a currency other than US Dollar for trading petroleum with nations other than US, all hell breaks loose all over American streets. Such scenario can guarantee American banks declaring bank holidays, ATM machines ceasing to function, utility electric/water grids going into frozen state, and all kinds of gloom and doom scenarios too numerous to mention here.

As said at the top: On top of Chinese US Treasury chill, this stuff would absolutely be comical and most freakishly hilarious - if only lives of billions of innocents all over the planet were not so hopelessly dependent on the madness.

Why Should China Keep Buying US Treasuries to QE Infinity (and beyond)?!

In Sanskrit, there is a saying:

विनाशकाले विपरीत बुद्धी.

Literally translated, it means: When faced with insurmountable odds and doom, human beings as a rule start unintentionally behaving in an illogical/irrational manner.

In the domain of macroeconomics, history books are littered with Mongol, Roman, Ottoman, Byzantine, British and various other mega-empires crumbling to dust as an application of this rule - either shooting themselves with self-inflicted warfare and/or combinations of other reasons.

[Slight digression. Advance apology to those unable to read Devanagari script: But I'm not going to bother transliterating the Sanskrit idiom above into Latin alphabet. Given my long multilingual and semi-formal/informal linguistics background, I've never personally been a fan of alphabet transliterations, since it's almost always impossible to retain identical effect while moving across random alphabet sets. If anyone has a burning desire to attempt transliteration, be my guest and attempt it with Google or various other online tools. Anyway, enough of this linguistic detour.]

Having set the stage with that wise saying naturally leads the flow into following headline:

QE Infinity? No end in sight for money printing

Actually, I take that part about "worthless" paper back. At times like these, it becomes imperative to quote that great thinker Ludwig von Mises:

Government is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.

Or in our situation, substitute the word "Government" with "Central Bank".

It might be easy to be a blog critic without holding controlling reins of enormous monetary policy. However, (to borrow American Football vocabulary) this isn't exactly armchair quarterbacking of events past being talked about. This is discussion of near future - and coming full-circle to that Sanskrit idiom - impending doom and gloom.

Even for an exercise of empty academic interest, one actually begins wondering about so-called logic within this illogic. I don't care where in the universe one travels, to distant solar systems within our own galaxy, distant galaxies or other empty voids unknown. But to the best of my knowledge and critical thinking, basic laws of mathematics and physics still apply across the entire universe. In the empty academic exercise, one actually begins to wonder if the pseudo-economists are intentionally setting things up for a guaranteed mathematical collapse. Or is that kooky conspiracy craziness? Nah, let's not even go there. It's been ages since terms like crazy kooky conspiracy were used in the domains of mathematics and physics. And the fundamental macroeconomics being discussed here is not exactly rocket science.

Only semi-rational analogy I can think of for this situation is, it's like a knot that keeps tightening further, the more you attempt to loosen it. Federal Reserve have gone so far down a precarious road that any attempts to take a U-turn seem even more precarious than continuing further down the dangerous road. This situation is absolutely as mind-blowing and surreal as it sounds reading these words.

This leads to a nice segue into next headline about "bury head in the sand ostriches" behavior of today's stock market conditions, in light of above pseudo-macroeconomic diarrhea.

Investors ignoring risk of China Treasury selling AND slowdown in China Treasury buying

Every passing day, my opinion keeps becoming firmer and firmer that: Macroeconomics, monetary and fiscal policies may be the only disciplines which are easier to teach to kindergarten aged children than adults.

विनाशकाले विपरीत बुद्धी.

Literally translated, it means: When faced with insurmountable odds and doom, human beings as a rule start unintentionally behaving in an illogical/irrational manner.

In the domain of macroeconomics, history books are littered with Mongol, Roman, Ottoman, Byzantine, British and various other mega-empires crumbling to dust as an application of this rule - either shooting themselves with self-inflicted warfare and/or combinations of other reasons.

[Slight digression. Advance apology to those unable to read Devanagari script: But I'm not going to bother transliterating the Sanskrit idiom above into Latin alphabet. Given my long multilingual and semi-formal/informal linguistics background, I've never personally been a fan of alphabet transliterations, since it's almost always impossible to retain identical effect while moving across random alphabet sets. If anyone has a burning desire to attempt transliteration, be my guest and attempt it with Google or various other online tools. Anyway, enough of this linguistic detour.]

Having set the stage with that wise saying naturally leads the flow into following headline:

QE Infinity? No end in sight for money printing

[...] Federal Reserve easing will go full-throttle until at least March. But even that thinking may be too aggressive.Until now, I've been extremely diligent to keep this blog's language family friendly clean, and devoid of offensive words. But quite seriously, after reading that Keynesian pseudo-economic diarrhea, is it even possible to stick to family friendly vocabulary? Seriously?!?!? Is this the garbage logic these one-trick pony pseudo-economists can come up with for cutting down more and more trees for worthless paper and keep using it to print worthless toilet paper "money"?

[...] $85 billion a month of so-called money printing would continue as long as the Fed and Chairman Ben Bernanke deemed necessary.

In a recent CNBC interview, Chicago Fed President Charles Evans said there was plenty of room left for more easing and plenty of reason to do it considering the still-uneven pace of economic recovery.

Actually, I take that part about "worthless" paper back. At times like these, it becomes imperative to quote that great thinker Ludwig von Mises:

Government is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.

Or in our situation, substitute the word "Government" with "Central Bank".

It might be easy to be a blog critic without holding controlling reins of enormous monetary policy. However, (to borrow American Football vocabulary) this isn't exactly armchair quarterbacking of events past being talked about. This is discussion of near future - and coming full-circle to that Sanskrit idiom - impending doom and gloom.

Even for an exercise of empty academic interest, one actually begins wondering about so-called logic within this illogic. I don't care where in the universe one travels, to distant solar systems within our own galaxy, distant galaxies or other empty voids unknown. But to the best of my knowledge and critical thinking, basic laws of mathematics and physics still apply across the entire universe. In the empty academic exercise, one actually begins to wonder if the pseudo-economists are intentionally setting things up for a guaranteed mathematical collapse. Or is that kooky conspiracy craziness? Nah, let's not even go there. It's been ages since terms like crazy kooky conspiracy were used in the domains of mathematics and physics. And the fundamental macroeconomics being discussed here is not exactly rocket science.

Only semi-rational analogy I can think of for this situation is, it's like a knot that keeps tightening further, the more you attempt to loosen it. Federal Reserve have gone so far down a precarious road that any attempts to take a U-turn seem even more precarious than continuing further down the dangerous road. This situation is absolutely as mind-blowing and surreal as it sounds reading these words.

This leads to a nice segue into next headline about "bury head in the sand ostriches" behavior of today's stock market conditions, in light of above pseudo-macroeconomic diarrhea.

Investors ignoring risk of China Treasury selling AND slowdown in China Treasury buying

Investors are failing to factor in the very real risk of China scaling back on its U.S. government debt holdings, economist Stephen Roach told CNBC.I didn't think, I needed to listen to someone with an official "economist" title for such basic common sense. This point is a bit of a rehash of a recent post in this blog. But how can you ignore such very important and rational point in this context?

"Everyone thinks interest rates are going to stay low in the U.S. because the Fed is in the control room... but the Chinese own about 11 percent of the Treasury market right now, and as they start to reduce their purchases of dollar-based assets... [this] will mean higher interest rates," he told CNBC Asia's Squawk Box.

Every passing day, my opinion keeps becoming firmer and firmer that: Macroeconomics, monetary and fiscal policies may be the only disciplines which are easier to teach to kindergarten aged children than adults.

Monday, October 28, 2013

Asia Pacific Bypassing US Dollar at an Alarming Rate!

Flurry of activity in monetary world bypassing US Dollar "reserve currency" is happening at such an alarming rate - especially in the Asia Pacific region - it's becoming a challenge staying on top of this all!

South Korea has gone on a tear, putting together native currency swap deals with multiple countries - United Arab Emirates, Indonesia, Malaysia - at a very rapid rate.

South Korea, Malaysia sign US$4.7 billion currency swap deal

With even bigger impact than South Korea, economic powerhouse China has gone on its own binge entering into native currency swap deals with multiple nations - Singapore, Australia, Japan, and even Britain!

China, Singapore to allow direct trading between currencies

These are of course logical and rational moves on part of these nations to secure themselves. Considering idiotic debt-ridden baggage associated with every single US Dollar, what else do you expect them to do? Enslave all of their populations to whims of short-sighted greedy bankers in far away lands? Suddenly, the "reserve currency" has started looking like no "reserve" currency at all.

Does the emperor have any clothes?

South Korea has gone on a tear, putting together native currency swap deals with multiple countries - United Arab Emirates, Indonesia, Malaysia - at a very rapid rate.

South Korea, Malaysia sign US$4.7 billion currency swap deal

SEOUL: South Korea and Malaysia on Sunday signed a currency swap agreement worth $4.7 billion, Seoul's central bank said, in a move to encourage bilateral trade and help curb currency swings.Granted, the upper caps of these deals don't seem too big amounts on global trade scales; more like pimples on an elephant's butt. But the point is that framework for bypassing unstability of US Dollar are being put in place. If future trade amounts among those nations pick up, there goes the US Dollar by the wayside.

The latest agreement allows the two Asian nations to purchase and repurchase each other's currency of up to 5 trillion won ($4.7 billion), or 15 billion ringgit, the central Bank of Korea said in a statement.

The latest agreement is the third currency swap deal South Korea has signed this month in a move to guard against financial turmoil and encourage trade with other emerging markets.

Asia's fourth-largest economy earlier this month struck currency swap deals worth $10 billion and $5.4 billion with Indonesia and the United Arab Emirates, respectively.

With even bigger impact than South Korea, economic powerhouse China has gone on its own binge entering into native currency swap deals with multiple nations - Singapore, Australia, Japan, and even Britain!

China, Singapore to allow direct trading between currencies

SINGAPORE: China and Singapore have agreed to allow direct trading between each other's currency, Singapore's central bank said on Tuesday.Granted, Chinese Renminbi is pegged to the US Dollar right now - to the ire of everyone in whatever little is left of American manufacturing sector. So mathematically under those constraints, it makes little difference if reverse trade with China is in US Dollar or Renminbi. But similar to the point with South Korea above, the main issue is that massive frameworks bypassing US Dollar in the future are being put in place at an alarming rate. One small tremor in uncertainities about US Dollar and voila, it can trigger chain reaction of massive earthquakes. The first prerequisite to such earthquakes could be un-pegging of Renminbi from US Dollar, which is quite conceivable while charting uncertain waters.

The move, along with other agreements on financial cooperation, is expected to bolster Singapore's status as a leading offshore trading centre for the Chinese yuan, officially called the renminbi (RMB).

"China and Singapore will introduce direct currency trading between the Chinese yuan and Singapore dollar," the Monetary Authority of Singapore (MAS) said in a statement, adding that details will be announced separately.

"The new initiatives will further promote the international use of the renminbi through Singapore," the MAS said.

Its managing director Ravi Menon added: "Financial ties between the two countries have deepened considerably and Singapore is well placed to promote greater use of the RMB in international trade and investment in the years to come."

China's rise as the world's second biggest economy has seen the yuan take on a bigger role in international financial markets.

Britain last week said that direct trading between the yuan and the British pound will be allowed.

China also has similar direct trading arrangements for the yuan with the US dollar, the Japanese yen and the Australian dollar.

These are of course logical and rational moves on part of these nations to secure themselves. Considering idiotic debt-ridden baggage associated with every single US Dollar, what else do you expect them to do? Enslave all of their populations to whims of short-sighted greedy bankers in far away lands? Suddenly, the "reserve currency" has started looking like no "reserve" currency at all.

Does the emperor have any clothes?

Sunday, October 20, 2013

China Putting Hard Brakes on US Treasuries, Shying away from US Dollar?

Amidst the "fake default" circus of last week, three alarming nuggets of information were released which bear repeating. They all are drums beating in China to start moving away from US Treasuries/US Dollar, and diversify into non-US Dollar alternates.

China Commerce Minister adviser warns may likely quit buying US Treasuries

Such hypotheticals aren't enough, there is more. There are already concrete diversification moves underway in China, away from the US Dollar! Hardly a surprise, sounds like a very logical move.

China foreign exchange reserve diversifying into real estate investments in Europe

China wonders: Why do we own so much U.S. debt?

China Commerce Minister adviser warns may likely quit buying US Treasuries

Commerce Minister adviser to Chinese government, Mei Xinyu said that if America does default on its loan obligations, China will likely quit buying U.S. Treasury bonds.Of course as blogged before, there was no question of any real debt obligation default. There were prospects of industrial complexes contract defaults. But that's besides the point. What's significant in above statement is someone from official Chinese government going on record, issuing warning of quitting to buy US Treasuries.

Such hypotheticals aren't enough, there is more. There are already concrete diversification moves underway in China, away from the US Dollar! Hardly a surprise, sounds like a very logical move.

China foreign exchange reserve diversifying into real estate investments in Europe

There have been media reports this week that China's State Administration of Foreign Exchange, the body that handles the country's $3.66 trillion of foreign exchange reserve, is looking to diversify into real estate investments in Europe.And while the last nugget doesn't involve pronouncement from any official Chinese government body, it is serious angst within social media in China about illogical over-dependence on debt-ridden US Dollar.

China wonders: Why do we own so much U.S. debt?

Zhaoge1982 asks, "What's wrong with China? You buy [America's] debt, they refuse to pay and what else can you do?

Wanwan7 writes, "China shouldn't have purchased so much U.S. debt. You think you are in control, but you are actually the real victim.

JPMorgan Chase in Record Corruption Settlement, No Criminal Prosecution yet!

When it rains, it pours! After last week's post highlighting alarming capital control measures by JPMorgan Chase, here comes yet another "bombshell" announcement regarding them over the weekend:

JPMorgan Chase in Record $13 Billion U.S. Settlement for High Level Corruption

One bank analyst Nancy Bush whining about JPMorgan not getting “waiver from criminal prosecution" in that article smacks nothing short of highway robbery. There has yet to be a single concrete criminal prosecution of a high level bankster over events of 5 years ago. There has yet to be a single high level bankster thrown into hard-labor prison. The banks themselves are being subjected to record settlement - which actually taking fractional-reserve (see paragraph below) and anticipated interest rate hikes into account is not a huge deal at all. Yet, individual criminal high level bankster executives are walking free or lazing around on yachts. Only smoke-and-mirrors "potential criminal liability" sometime in the future is being dangled to American taxpayers. Sometime in the future, are you kidding me? It's coming up to end of 2013 already, when is that "potential in the future" day going to dawn? Rhetorical question that, no need for an answer.

Talking about fractional-reserve dilution point mentioned above: Shed no tears over the "record $13 billion fine" for one of the biggest recepients (in trillions!) of fractional-reserve scam. With combination of fiat monetary policy and fractional reserve banking, these are mere virtual digits created out of thin air. The real issue is concrete criminal prosecution of criminal executives engaged in these worst corrupt frauds known to mankind. Without any movements on that front, these "bombshell" announcements amount to nothing but diluted tears in a tea cup.

JPMorgan Chase in Record $13 Billion U.S. Settlement for High Level Corruption

JPMorgan Chase & Co.’s record $13 billion deal to end U.S. probes of its mortgage-bond sales would free the nation’s largest bank from mounting civil disputes with the government while leaving a criminal inquiry unresolved.Is the timing of these 2 seemingly unrelated events co-incidental? Or is there some convoluted twisted sub-plot underneath the surface? Meaning, did the Feds impose capital control requirements on JPMorgan Chase as part of this settlement? Things that make you say, hmm.

One bank analyst Nancy Bush whining about JPMorgan not getting “waiver from criminal prosecution" in that article smacks nothing short of highway robbery. There has yet to be a single concrete criminal prosecution of a high level bankster over events of 5 years ago. There has yet to be a single high level bankster thrown into hard-labor prison. The banks themselves are being subjected to record settlement - which actually taking fractional-reserve (see paragraph below) and anticipated interest rate hikes into account is not a huge deal at all. Yet, individual criminal high level bankster executives are walking free or lazing around on yachts. Only smoke-and-mirrors "potential criminal liability" sometime in the future is being dangled to American taxpayers. Sometime in the future, are you kidding me? It's coming up to end of 2013 already, when is that "potential in the future" day going to dawn? Rhetorical question that, no need for an answer.

Talking about fractional-reserve dilution point mentioned above: Shed no tears over the "record $13 billion fine" for one of the biggest recepients (in trillions!) of fractional-reserve scam. With combination of fiat monetary policy and fractional reserve banking, these are mere virtual digits created out of thin air. The real issue is concrete criminal prosecution of criminal executives engaged in these worst corrupt frauds known to mankind. Without any movements on that front, these "bombshell" announcements amount to nothing but diluted tears in a tea cup.

Thursday, October 17, 2013

JPMorgan Chase Heralds Soviet Cyprus Style Capital Controls!

All this cacophony and propaganda lies were conveniently engineered by the single party dictatorship system ruling the country, with 2 Democrat and Republican wings of the same party pretending to squabble with each other. But this 1 party dictatorship with 2 wings is answerable only to its masters - various industrial complexes enumerated above. The 2 different Democrat-Republican wings of single party dictatorship have identical goal of enslavement of American populace - psychologically or otherwise. It's just that their approaches on how to go about enforcing such enslavement have minor logistical differences.

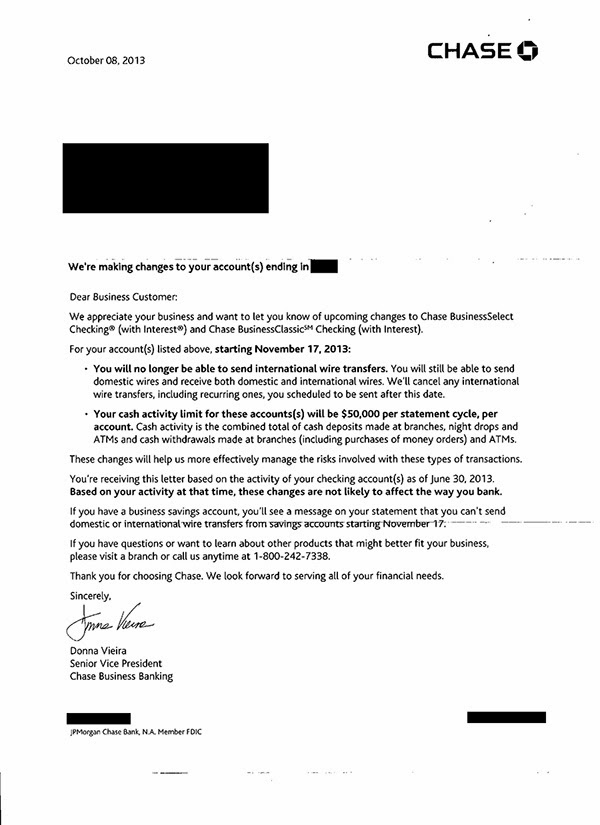

Lost among all these farcical distractions was a far more momentous headline. It goes without saying, no state run propaganda media would bother reporting about matters of such importance. It is that Soviet Cyprus Union style capital controls and cash withdrawl limits are already upon us!

Don't believe it? Think it's some reactionary kooky stuff? Take a look at following image upload of JPMorgan Chase letters sent to business banking customers last week. Proof is in the pudding, no more words are necessary to express indignation about upcoming engineered social upheavals.

Not directly related to this capital control news, but to the government "shutdown"-debt ceiling-debt contract default charade theater:

Xinhua, which itself happens to be state run propaganda media arm of Chinese government ran a curiously scathing editorial last Sunday, which caught the eye. Especially, I found the following snippet towards the end of this editorial quote-worthy.

China Xinhua state media runs editorial asking for New International Reserve Currency

What may also be included as a key part of an effective reform is the introduction of a new international reserve currency that is to be created to replace the dominant U.S. dollar, so that the international community could permanently stay away from the spillover of the intensifying domestic political turmoil in the United States.

Sunday, June 30, 2013

Democracy defined (American and Indian versions)

Updating with a new post of incisive and humorous observations on the much maligned and propagandized term called "democracy". Surely such observation can be repeated with variations in many other countries with so-called "democracies"; be it Canada, Australia, Germany, UK, whatever. Since my personal familiarity is best with climates in USA and India, doing these as American and Indian versions respectively.

============

Definition of "Democracy" (American version) :

I want people who know ALL about Kim Kardashian's sex life, Kobe Bryant's affairs, Tom Brady's pass completion percentage & list of Dancing with the Stars winners by heart, but have no clue or interest about:

============

Definition of "Democracy" (Indian version) :

I want people who know ALL about affair between Salman Khan & Madhuri Dixit, Vijay Mallya's spending details in IPL & Formula-1, Rahul Dravid's test batting average, list of Indian Idol winners by heart, but have no clue or interest about:

============

Definition of "Democracy" (American version) :

I want people who know ALL about Kim Kardashian's sex life, Kobe Bryant's affairs, Tom Brady's pass completion percentage & list of Dancing with the Stars winners by heart, but have no clue or interest about:

- Meaning of Fractional reserve banking,

- Meaning of 4th Amendment if it bit them in the rear,

- Tax subsidization of big agriculture by lobbyist collusion with chemical fertilizer industry,

- Perspective of US history, such as Gulf of Tonkin, Operation Ajax or Operation Northwoods deceptions

- My retirement savings being stolen by lying, thieving bank executives,

- My children being committed to harm's way fighting wars under false pretexts against countries that haven't attacked the US, so that some bank executives get rich speculating on physical resource grab of those countries,

- Immunity & general health of myself & my descendants' generations affected by lobbyist subsidized pseudo-foods

============

Definition of "Democracy" (Indian version) :

I want people who know ALL about affair between Salman Khan & Madhuri Dixit, Vijay Mallya's spending details in IPL & Formula-1, Rahul Dravid's test batting average, list of Indian Idol winners by heart, but have no clue or interest about:

- Meaning of Fractional reserve banking,

- FDI Foreign Development Initiative Walmart kickbacks,

- Monsanto kickbacks for BT cotton & BT brinjal to politicians in Gujarat & Maharashtra & their effect on farmer suicides in Maharashtra,

- Water quality & quantity crisis in North India due to de-forestation & crony subsidization of hybrid seeds,

- Perspective of Indian history, such as Indira Gandhi's emergency rule, "green revolution 5 year plan" scams in Punjab giving birth to Khalistan unrest

- My retirement savings being stolen for bailing out Vijay Mallya's private airline OR corrupt agriculture minister moving them offshore in Swiss bank accounts,

- Mineral mining resources of Karnataka & Jharkhand strip-stolen by lying globalist bankers using World Bank & IMF pretext lies,

- Immunity & general health of myself & my descendants' generations affected by lobbyist subsidized pseudo-foods,

- My physical security in metros being ignored despite genuine intelligence info on internal unrest, at expense of corrupt criminal Chief Minister of Uttar Pradesh getting extra-special 24/7 police security

Thursday, April 25, 2013

Federal Reserve desperation resorts to Comic Book propaganda format

From the "Unsure whether to be bemused or bewildered" department:

I was pointed to a new discovery by someone, which I had been completely unaware of till now. The Federal Reserve is engaged in a highly aggressive, highly dumbed down campaign of propaganda dissemination in comic book format about their fractious/dubious charter! I kid you not, it is for real provided at the following link from New York Fed. Generally, it is considered a sign of PR desperation when any elusive entity has to resort to comic book format to justify their existence.

Federal Reserve dumbed down comic book format propaganda

With the fear that such comic books may be taken down sometime in the future, I'm taking liberty of screen capturing some select pages from this abomination and attaching screenshots here.

I was pointed to a new discovery by someone, which I had been completely unaware of till now. The Federal Reserve is engaged in a highly aggressive, highly dumbed down campaign of propaganda dissemination in comic book format about their fractious/dubious charter! I kid you not, it is for real provided at the following link from New York Fed. Generally, it is considered a sign of PR desperation when any elusive entity has to resort to comic book format to justify their existence.

Federal Reserve dumbed down comic book format propaganda

With the fear that such comic books may be taken down sometime in the future, I'm taking liberty of screen capturing some select pages from this abomination and attaching screenshots here.

What is next in the propaganda brainwashing campaign? Rewriting all high school economics textbooks on monetary policy, such that the lie "Central Bank backed fiat monetary policy is THE ONLY VALID monetary policy" gets stamped onto brains of high school students? Wait, that has already been taken care of.

What worse level will the Fed stoop to next? Indoctrination campaign for minds of pre-school aged children, such that they become lemmings on a conveyor belt even before any critical thinking sets in? How about these for inclusion in pre-school propaganda curriculum, along with teaching alphabets, numbers, colors, animal names and the rest?

- Worship paper currency

- Worship digital debts created out of thin air, especially the ones for which interest will be mathematically unpayable; basically worship a perpetual usury culture

- Worship spending of all forms, with no consideration for future consequences

- Worship fractional reserve banking

- Disregard planning for physical resources

That's right, get the brains of those children enslaved as early as possible. No enslavement is more powerful than enslavement of the mind.

Friday, February 22, 2013

Chinese Central Bank research head issues dubious report

From the surreal department this week:

China loves the US dollar again as America roars back

Could the statement from Chinese Central Bank have anything to do with the fact that: They are stocked up on such an enormous load of US Treasuries, and are forced to keep them propped up with not many avenues left to unload them? A sort of calm before the storm perhaps?

China loves the US dollar again as America roars back

Jin Zhongxia, head of the central bank’s research institute, said America’s energy revolution and export revival had shaken up the global landscape and would lead to a stronger dollar over time. “The dollar’s global dominance will continue,” he said.Not sure what reality this fellow lives in, but in the reality I'm examining United States is on projection to:

- Spend $38 trillion in national budget over next 10 years

- Spend $14 trillion over 10 years purely on borrowed money (deficit spending)

- Bogus sequestration debate going on right now only refers to cuts of $1.2 trillion over those same 10 years, with "sky will be falling if those cuts are done" propaganda to use scare tactics even about this issue

Nothing about the propagandized and in-denial state of today's American fiscal policy has anything remotely in sync with predictions in that report. Name me one state or empire on the face of this planet which built its way to prosperity with a perpetual welfare-warfare policy. Oh right, The Roman Empire? Proves the point.

And that's just a point about fiscal policy alone. I'm not even referring to the smoke and mirrors monetary policy.

Tuesday, February 19, 2013

Bye-bye to Canadian Penny coin! US Penny to follow suit too?

A story from 2 weeks ago which probably did not get as much publicity as it should have, considering the amount of concerns it raises:

Canada stops distribution of penny coin

The situation is remarkably parallel in the US. The US Mint which is a legitimate government entity, being a child organization of The US Treasury has authority over all coinage in the US. It has absolutely no relationship with the private Federal Reserve central bank, apart from distribution of coins from the mint. In hazy terms, all metal coins in the US represent something more genuinely representing "money", as opposed to the fiat paper currency.

Canada stops distribution of penny coin

The Canadian penny is being withdrawn from circulation because production costs have exceeded its monetary value.This coin, most of which was composed of a steel-nickel alloy with copper plating dropped in value compared to the cost of the metal itself! The Royal Mint of Canada has authority over coinage in Canada. This is not an authority which falls in the jurisdiction of the "Bank of Canada" central bank issuing fiat paper currency.

The Royal Canadian Mint will no longer distribute the coin to financial institutions around the country, but it will remain legal tender.

The situation is remarkably parallel in the US. The US Mint which is a legitimate government entity, being a child organization of The US Treasury has authority over all coinage in the US. It has absolutely no relationship with the private Federal Reserve central bank, apart from distribution of coins from the mint. In hazy terms, all metal coins in the US represent something more genuinely representing "money", as opposed to the fiat paper currency.

- Issuance of coins is actually under jurisdiction of a legitimate government body of US Treasury, as opposed to fiat paper notes.

- As authorized by US Constitution, the US Congress does in fact have authority over issuance of coins. The US Congress has absolutely no authority over issuance of fiat paper currency, ever since the fateful Federal Reserve Act of 1913. The fact that the coins don't conform to the "Only gold and silver as legal tender" part of US Constitution is a separate and far bigger topic. This is the reason for my use of the word "hazy" above.

- The coins actually are backed by some physical resource of tangible value; the metal out of which they're coined. The fact that the value of these metals fluctuates and most of the times is supposed to be negligible compared to the coin face value is besides the point. As the Canadian penny example illustrates, metal value fluctuations or inflation can actually make the backing resource more valuable than coin face value itself. In comparison, the fiat paper currency notes have practically no physical resource backing them. That is exactly the definition of the word 'fiat' in the first place.

- And by the way, yes, in a past life I did in fact work as a Chemical Engineer in the paper industry. Nobody with a straight face can tell me that the physical resource of paper "backing" US paper notes amounts anywhere close to their face value. At least we haven't yet reached that Zimbabwe or Argentina level of hyperinflation yet. But you never know, which is one of the reasons this blog came into existence in the first place!

To come back to the point, all US metal coins are something far more genuinely representing "money", as opposed to the fiat paper notes. If every single person holding any paper assets in American currency were to go to a bank tomorrow, and request conversion of such assets into coins, overnight it would bring the American economy tumbling down like the deck of cards it is. By corollary, it would also take down the entire global economy tumbling down with it. Of course, such a scenario will not ever take place; but you get the point about importance of coins in American currency system.

Considering these facts, if the retirement of Canadian penny ever has a parallel in the US (retirement of American penny), it would be an extremely worrying sign. At an elementary level, proportionality of something genuinely representing "money" compared to fiat currency would drop.

I say, the American public better watch out for signs of any such moves of removing metal coins out of circulation in the US. And especially not be hoodwinked by any propaganda of "equal conversion between coins and paper currency to be guaranteed by Federal Reserve central bank", under any circumstances.

Saturday, February 16, 2013

French government tightening cash transaction controls

In first signs of currency crunch pre-shocks and associated government overreaches, here comes a headline from troubled Europe:

France Plans To Prohibit Cash Payments Over €1,000

No, seriously this reads like a big warning. It calls for an even bigger increase of overly bloated and dysfunctional government bureaucracies. All the while absolutely no solution for the root cause of ailing currency crisis is even part of proposed remedy.

As ridiculous and "across-the-ocean" this may sound to American populace, it is in fact a strong warning of an impending tsunami on these shores. Such "tightening controls" are exactly what await here, as no real solution for deficit reduction has ever been discussed by US Congress and Executive Branch during the "debt ceiling" circus. The level of discussion during that circus was of the level of "whether to curtail proposed spending increases from 20% to 19%".

There are strong historical precedents for such dishonesty, for example in the collapse of the Roman Empire. This script has played out with an eerie familiarity before.

France Plans To Prohibit Cash Payments Over €1,000

France becomes the latest as Prime Minister Jean-Marc Ayrault plans to erect new controls on cash transactions in order to tighten up tax collection and meet the country’s optimistic budget deficit target of 3% of GDP. The government needs euros and they need some fast.Uh-oh.

In the government plan labeled “Fight against fraud,” France’s fiscal residents would see the cash transaction limit decrease from €3,000 to €1,000 per purchase.

No, seriously this reads like a big warning. It calls for an even bigger increase of overly bloated and dysfunctional government bureaucracies. All the while absolutely no solution for the root cause of ailing currency crisis is even part of proposed remedy.

As ridiculous and "across-the-ocean" this may sound to American populace, it is in fact a strong warning of an impending tsunami on these shores. Such "tightening controls" are exactly what await here, as no real solution for deficit reduction has ever been discussed by US Congress and Executive Branch during the "debt ceiling" circus. The level of discussion during that circus was of the level of "whether to curtail proposed spending increases from 20% to 19%".

There are strong historical precedents for such dishonesty, for example in the collapse of the Roman Empire. This script has played out with an eerie familiarity before.

Say what?! Amazon enters digital currency fray!

On heels of the recent Bitcoin discussion, a rather surprising new development to report. Online retailer giant Amazon has jumped into the fray of digital currency, cryptography and semi-bartering.

With Amazon minting currency, Fed at risk

Canadian Tire Money

But most certainly, Amazon is a lot bigger corporation - a giant - compared to Canadian Tire. Their overall business model also involves commodities/services of lot more diverse nature. On a related note, let us also not for forget all the controversy surrounding dubious sales tax imposition by State of California on Amazon from last year.

Amazon.com and California Sales Tax brouhaha

Getting back to the original topic, issuance of competing currency by a major American corporation opens up a very interesting can of worms. If Amazon now, what's next? eBay/PayPal with their own version of competing currency? Such ideas set the stage for major headaches for central bankers; not to mention various government taxation policies.

A big difference between such corporation competing currencies and Bitcoin however is, Bitcoin follows a completely distributed, un-centralized model. An almost anarchic one, to put it shortly. If central bankers/government bodies feel threatened by competing currencies issued by corporations and wish to kill them with the force of gun, at least they have centralized entities to target. It is a lot harder to do with Bitcoin.

In any event, the fun is just getting started with the Wild Wild West world of competing currencies. Fasten your seat belts if/when getting on the wild ride!

With Amazon minting currency, Fed at risk

This month, Amazon launched its own coins — a virtual currency that can be used to buy stuff for your Kindle tablet. It is a very tentative move to start with: more like loyalty points on a reward card than actual cash. But every river needs to start with a spring — and with the web’s mightiest retailer behind it the coins could grow into something significant.Say what again?! Amazon, a giant public corporation is planning to compete with central banking - more specifically Federal Reserve - and their fiat money printing monopoly? Surely, it is not the first time something like this is happening with private sector loyalty money in a Western industrial nation. The most famous and old case is with loyalty money from Canadian Tire Corporation in Canada. Check below for more information.

Canadian Tire Money

But most certainly, Amazon is a lot bigger corporation - a giant - compared to Canadian Tire. Their overall business model also involves commodities/services of lot more diverse nature. On a related note, let us also not for forget all the controversy surrounding dubious sales tax imposition by State of California on Amazon from last year.

Amazon.com and California Sales Tax brouhaha

Getting back to the original topic, issuance of competing currency by a major American corporation opens up a very interesting can of worms. If Amazon now, what's next? eBay/PayPal with their own version of competing currency? Such ideas set the stage for major headaches for central bankers; not to mention various government taxation policies.

A big difference between such corporation competing currencies and Bitcoin however is, Bitcoin follows a completely distributed, un-centralized model. An almost anarchic one, to put it shortly. If central bankers/government bodies feel threatened by competing currencies issued by corporations and wish to kill them with the force of gun, at least they have centralized entities to target. It is a lot harder to do with Bitcoin.

In any event, the fun is just getting started with the Wild Wild West world of competing currencies. Fasten your seat belts if/when getting on the wild ride!

Tuesday, February 5, 2013

Virginia pushes for own non-Central Bank currency & other Bitcoin musings

Couple of separate issues to blog about today, although at a high level both of them are related in the aspect of "competing parallel currencies".

Fresh off of the press from few hours ago, legislature in Virginia moves closer to investigate feasibility of their own currency!

Push for own currency in Virginia moves closer to reality

Regardless of whether such an idea ends up being "pie-in-the-sky" as of today, the very fact that there is even discussion at a state legislature level to challenge Federal Reserve's hegemony is a big achievement. The Fed's out of control money printing encourages governments at various levels to run up unsustainable debts. Injecting more paper currency into money supply in such situation is akin to providing more drug syringes to an out of control drug addict. It takes constitutional conservatives in such an environment to seriously discuss the societal danger posed by out-of-control debts. One can only hope that such conversation moves to state legislatures in more and more states across the country.

And continuing with Bitcoin related discussion from previous post, here is a snippet of actual Bitcoin discussion from mainstream media!

Bitcoin in mainstream media news

Ignoring the obligatory portions in which it talks about "transactions by criminals", "shady underworld dealings" etc., once again the conversation of a non-Central Bank backed currency is slowly creeping in at more and more mainstream places. There is nothing more capitalistic and free-market than a discussion of competing currencies themselves. If a loosely coupled digital currency like Bitcoin ends up being flawed, fine. So be it, but let the market decide such successes or failures. Prospects of debasement of the "other big monopolistic reserve currency" do not inspire a lot of confidence either.

Fresh off of the press from few hours ago, legislature in Virginia moves closer to investigate feasibility of their own currency!

Push for own currency in Virginia moves closer to reality

Regardless of whether such an idea ends up being "pie-in-the-sky" as of today, the very fact that there is even discussion at a state legislature level to challenge Federal Reserve's hegemony is a big achievement. The Fed's out of control money printing encourages governments at various levels to run up unsustainable debts. Injecting more paper currency into money supply in such situation is akin to providing more drug syringes to an out of control drug addict. It takes constitutional conservatives in such an environment to seriously discuss the societal danger posed by out-of-control debts. One can only hope that such conversation moves to state legislatures in more and more states across the country.

And continuing with Bitcoin related discussion from previous post, here is a snippet of actual Bitcoin discussion from mainstream media!

Bitcoin in mainstream media news

Ignoring the obligatory portions in which it talks about "transactions by criminals", "shady underworld dealings" etc., once again the conversation of a non-Central Bank backed currency is slowly creeping in at more and more mainstream places. There is nothing more capitalistic and free-market than a discussion of competing currencies themselves. If a loosely coupled digital currency like Bitcoin ends up being flawed, fine. So be it, but let the market decide such successes or failures. Prospects of debasement of the "other big monopolistic reserve currency" do not inspire a lot of confidence either.

Wednesday, January 30, 2013

Bitcoin: Threat to Central Banking. Government bans of Bitcoin will fail miserably!

This is more of wrapper blog post, around another excellent blog post from Forbes I found. It has to do with Bitcoin.

What exactly is Bitcoin, you ask? Well, if you're not yet caught up with the burgeoning field of P2P digital currency and cryptography of Bitcoin, I would suggest you to do so strongly and urgently. It promises to be the future, especially due to uncertainities of massive sovereign debts being accumulated by big and corrupt governments.

Go here:

About Bitcoin

and here:

What is Bitcoin?

Even a mainstream airline like Emirates has a dedicated article talking about the Bitcoin effect in their latest in-flight magazine of February 2013. Check from page 70 (in the actual PDF file, page no. 72) in following PDF file:

The Bitcoin Effect in Emirates In-Flight February 2013 magazine

A much older article in Wired magazine from 2011 discussing early adoption issues with Bitcoin: [The title of the article itself is reactionary, considering late 2011 was very early to already declare "Fall of Bitcoin".]

The Rise and Fall of Bitcoin

To summarize very quickly: Bitcoin is a MASSIVE threat to the monopolistic hegemony of Central Banking systems all over the planet. Bitcoin is the ultimate free market monetary system. Bitcoin poses threat to the crony "Politburo" system of Central Banking which can:

Not surprisingly, seeing what a big threat Bitcoin can be to the Fiat Currency model, big governments of the world will not take it easily lying down to it at first. There are murmurs developing of government bans on this wildly crazy idea of free market digital currency. Free market, who would have ever thought of that?

Following is the excellent article from Forbes I found, which claims that such attempts to ban Bitcoin by big governments will fail miserably.

Government Ban On Bitcoin Would Fail Miserably

Here is the best bit:

The genie is out of the bottle!

What exactly is Bitcoin, you ask? Well, if you're not yet caught up with the burgeoning field of P2P digital currency and cryptography of Bitcoin, I would suggest you to do so strongly and urgently. It promises to be the future, especially due to uncertainities of massive sovereign debts being accumulated by big and corrupt governments.

Go here:

About Bitcoin

and here:

What is Bitcoin?

Even a mainstream airline like Emirates has a dedicated article talking about the Bitcoin effect in their latest in-flight magazine of February 2013. Check from page 70 (in the actual PDF file, page no. 72) in following PDF file:

The Bitcoin Effect in Emirates In-Flight February 2013 magazine

A much older article in Wired magazine from 2011 discussing early adoption issues with Bitcoin: [The title of the article itself is reactionary, considering late 2011 was very early to already declare "Fall of Bitcoin".]

The Rise and Fall of Bitcoin

To summarize very quickly: Bitcoin is a MASSIVE threat to the monopolistic hegemony of Central Banking systems all over the planet. Bitcoin is the ultimate free market monetary system. Bitcoin poses threat to the crony "Politburo" system of Central Banking which can:

- Arbitrarily fix interest rates by having a meeting of bureaucrats sitting in a conference room.

- Arbitrarily print more and more fiat money out of thin air, diluting value of funds for those who've already saved "money".

- In an extreme scenario, create hyperinflation and plunge societies into catastrophic instability.

Not surprisingly, seeing what a big threat Bitcoin can be to the Fiat Currency model, big governments of the world will not take it easily lying down to it at first. There are murmurs developing of government bans on this wildly crazy idea of free market digital currency. Free market, who would have ever thought of that?

Following is the excellent article from Forbes I found, which claims that such attempts to ban Bitcoin by big governments will fail miserably.

Government Ban On Bitcoin Would Fail Miserably

Here is the best bit:

I maintain that a government ban on bitcoin would be about as effective as alcohol prohibition was in the 1920s. Government prohibition doesn’t even do a good job of keeping drugs out of prisons.The best strategy for corrupt governments of the world with runaway debts is to hope Bitcoin goes away or becomes irrelevant. Unless there is a single coordinated plan with the force of gun to kill Bitcoin, it isn't going away.

The genie is out of the bottle!

Friday, January 18, 2013

Goldman "Federal Bailout" Sachs wants to PUSH DOWN gold prices

OK, so today we have the Goldman "Federal US Taxpayer Funded Bailout" Sachs among a headline that caught the eye.

The same Goldman Sachs whose ex-CEO Hank Paulson was Treasury Secretary when that bailout was engineered?!? Yes, that one.

The same Goldman Sachs leading in campaign contributions for the Obamney-Rombama duopoly-monopoly political circus?!?! Yes, yes. The same one.

So in this headline, the same Goldman Sachs cries out for worldwide gold prices to plummet.

Goldman sees gold falling $500 an ounce as rally loses its shine

Because the US debt is skyrocketing, each year charade of raising debt ceiling keeps pushing it to infinity and beyond? Because borrowing US Treasuries has lesser and lesser credibility each passing day? Because the viability of Euro hangs in the balance with turmoils in countries like Spain kept suppressed with government repression? Because Japan has no signs of recovery yet out of its prolonged doldrums? Because a central bank like Bundesbank is getting nervous about credibility of US Federal Government and Eurozone to keep their fiat currencies propped up? Specifically because Bundesbank is getting desperate to repatriate large chunk of their gold?

There couldn't possibly be any ulterior motive for why Goldman Sachs would get on the rooftop and cry such a warning, could it? It must be a parallel universe that against the backdrop of realities stated above, Goldman Sachs needs to make such a sharp warning.

I'll leave you with the resource for GATA (Gold Anti-trust Action Committee) to investigate. Specifically, in order to keep the hollow empire of fiat currencies afloat, GATA alleges a well-coordinated plot by powerful international banking conglomerates to keep gold prices artificially low. Google GATA for more information. Here is the starter link:

Gold Anti-Trust Committee

The same Goldman Sachs whose ex-CEO Hank Paulson was Treasury Secretary when that bailout was engineered?!? Yes, that one.

The same Goldman Sachs leading in campaign contributions for the Obamney-Rombama duopoly-monopoly political circus?!?! Yes, yes. The same one.

So in this headline, the same Goldman Sachs cries out for worldwide gold prices to plummet.

Goldman sees gold falling $500 an ounce as rally loses its shine

Because the US debt is skyrocketing, each year charade of raising debt ceiling keeps pushing it to infinity and beyond? Because borrowing US Treasuries has lesser and lesser credibility each passing day? Because the viability of Euro hangs in the balance with turmoils in countries like Spain kept suppressed with government repression? Because Japan has no signs of recovery yet out of its prolonged doldrums? Because a central bank like Bundesbank is getting nervous about credibility of US Federal Government and Eurozone to keep their fiat currencies propped up? Specifically because Bundesbank is getting desperate to repatriate large chunk of their gold?

There couldn't possibly be any ulterior motive for why Goldman Sachs would get on the rooftop and cry such a warning, could it? It must be a parallel universe that against the backdrop of realities stated above, Goldman Sachs needs to make such a sharp warning.

I'll leave you with the resource for GATA (Gold Anti-trust Action Committee) to investigate. Specifically, in order to keep the hollow empire of fiat currencies afloat, GATA alleges a well-coordinated plot by powerful international banking conglomerates to keep gold prices artificially low. Google GATA for more information. Here is the starter link:

Gold Anti-Trust Committee

Thursday, January 17, 2013

Bundesbank launches simultaneous 2-pronged attack on US Dollar and Euro!

And finally: So it begins with the ringing of the first bell!

In news that is of earth-shattering consequence to currency warfare, Bundesbank [German Central Bank] drops a bomb. Well, not exactly. Mutterings regarding need to audit gold belonging to Bundesbank, but held outside Germany had been occurring in German press few months ago. So this is not exactly very surprising news. What has followed now is an all out demand for repatriation of a lot of this gold.

Bundesbank to pull gold from New York and Paris in watershed moment

Now, I'm not going to quote cut-pasted extracts from this article; because in my opinion the article commentary itself is somewhat muted. My personal take is a lot stronger.

Quite frankly, I believe this is a simultaneous 2-pronged attack by Bundesbank on both the US Dollar AND the Euro! After the fiasco of yet another US debt-ceiling raise, Bundesbank is making it clear that they have no confidence left in any hallowed status for US Dollar. It has no confidence left in the money printing one trick pony schemes of Federal Reserve. Specifically, if and when the US debt panic accelerates, Bundesbank has no confidence left if Federal Reserve will account its foreign gold holdings towards US holdings instead. On the basis of contract rights, that is a very strong sentiment and is really saying something.

Now even more curious is the attack on the credibility of Euro itself. Does that even make sense, meaning Euro being the currency of use in Germany right now? It's quite simple. What Bundesbank is doing is asserting its sovereignty over and above European Central Bank. In my opinion, they're well within their rights entitled to it. This is a perfectly logical and justifiable move. [From American perspective, the closest equivalence to this I can think of is the Tenth Amendment and state's rights/sovereignty issue.]

Against this backdrop, consider the disingenuous efforts of Angela Merkel's German government recently regarding bailouts of Greek and Spanish economies. Consider the proclamations of "wanting to do everything in their power to protect hallowed status of Euro". Actions of Bundesbank in demanding repatriation of ALL of its gold out of France seem to be diametrically opposed to the actions of German government.

It's going to be very interesting checking what official response Federal Reserve and US Government give to this demand. Most predictable response I can think of is Obama, Ben Bernanke and the new US Treasury Secretary running off to Germany, and trying to put pressure on German government to put off this demand. [Whatever is the name of this Treasury Secretary after Timothy Geithner, I'm too lazy to look it up. And in my opinion that position has become subservient to Federal Reserve anyway.] But it's not as if they have too many options. They certainly can't declare war on Germany over this issue, can they?